JUDICIA CONSEILS was set up in 1989 and is a leading, independent firm of corporate lawyers in Alsace.

Coming from a range of backgrounds such as university, tax administration and business, the men and women working in the firm are supremely aware of the plans and issues occupying companies and their leaders. Most of the staff are bilingual or trilingual.

This wealth of experience and the firm’s location have enabled JUDICIA CONSEILS to gain extensive experience in France and in international business, in particular Franco-German.

The Firm has developed within a culture of consultancy in order to provide support for company’s plans, help tackle their problems and advise their leaders pragmatically and effectively.

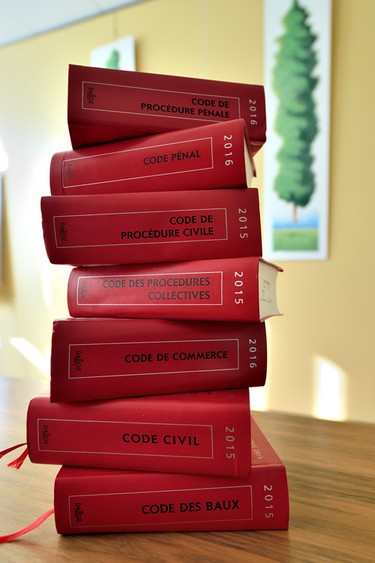

Building on the premise that effectiveness requires specialisation, the Firm’s practice areas cover all aspects of corporate law, from taxation to consumer law, from commercial litigation to criminal proceedings, by way of labour and social security law, not forgetting business reorganisation and the establishment of foreign companies.

JUDICIA CONSEILS’ effectiveness is based on a working approach and methodology steadfastly focusing on its clients:

- Awareness and responsiveness;

- Pragmatic, personalised solutions;

- Active, appropriate legal monitoring;

- Flexible consultation methods in keeping with clients’ specific requirements.

Thanks to this expertise and technical experience JUDICIA CONSEILS also cooperates with other business consultants, lawyers and accounting professionals wishing to enlist the support of specialised lawyers to enable them to complete their range of services.

The Firm also benefits from the support of experienced correspondents abroad.

The entire JUDICIA CONSEILS team is at your disposal to help you accomplish your corporate plans and to assist you with all the issues that occupy you.